Just get a voluntary damage to property rider added for xxxx amount. Insurance companies can do that if need be.

Erie doesn’t write in Missouri.

Liberty Mutual

but travelers covers it too

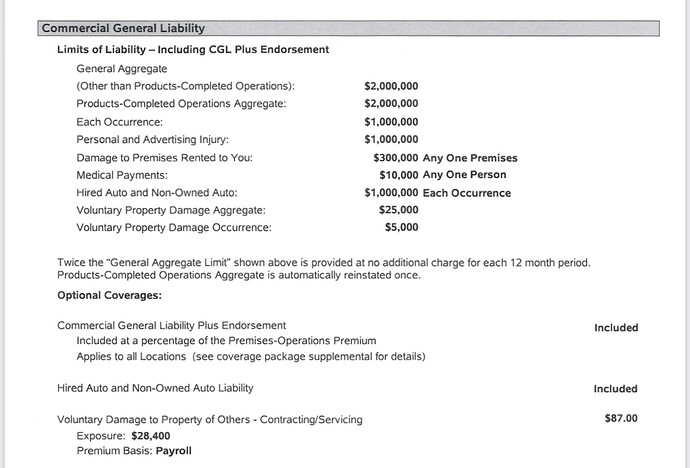

Heard that voluntary property damage is the same as CCC. Is that true? Here is a list of the coverages I’ve been quoted.

From my understanding it is, it pays for what you damage while working or your workmanship.

I’d ask what the difference is between “aggregate” vs “occurrence”. And depending on the definition, I’d up the “occurrence” amount. If you mess up a deck or a driveway, you’re looking at way more than $5k.

Occurrences is per incident. Aggregate is the max amount that they will pay and that premium year. So if you had 5 claims and those 5 accidents / occurrences cost $5000 each, you used all $25,000 aggregate for the year. That also means you probably shouldn’t be pressure washing anymore and your insurance would probably drop you lol

![]()

I’m in Illinois as well. Who is your insurance through?

Who is your insurance through? I’m in Florida and looking for insurance now. Thanks

He hasn’t been online in a little while, since summer that I recall.

@DSJ1 and @Stealthbobber06, Marine has Auto Owners as his carrier. Just see if your agent can get a quote through Auto Owners if that’s who you want as your carrier.

I have auto owners as well. Not for business, they were too high for me personally, but for my truck and trailer.

Who did you end up picking for business and how much? You would just have GL as you don’t have employees right?

Joseph Walters. They don’t allow walking of the roof but I’m fine with that. Erie doesn’t serve MO and no other company I spoke to knew what CCC was so. Correct no employees. Sole proprietorship here

Pretty sure Erie covers SC, have you given them a call? I couldn’t be happier with my coverages and rate

Edit: nevermind, I just read Racer’s post from awhile back. They don’t cover SC. My bad

Not walking the roof won’t work for me. Window cleaning requires getting on the roof sometimes, and that is still my bread and butter. I’m glad you found someone that works for you!

I’m currently with Auto Owners as I was getting quotes for 3k since I use a wfp above 50 ft, and the other companies didn’t care that it wasn’t me at that height, just the pole. Auto owners customer wrote a policy for 1100 that said I couldn’t be higher than 2 stories, but my pole could be as high as I want. I’m waiting on a quote now, and I’m hoping it’s not through the roof for GL, workmans comp, and auto for pw and wc.

@Jake_Lambert, too bad Erie doesn’t service SC. I was going to try to call them for a second quote.

Edit-that amount is just window cleaning. Double what I paid up to 4 floors, but not 3k at least. When I started last year my agent put my policy on pw as an as use basis, so basically I’ll pay the premium come June based on how much pw I’ve done.

Well since we’re on the topic of insurance lately, once auto owners found my booboo back in 2018 going 122 on the highway( had a sports car then), they declined me… so now I’m on the hunt for commercial auto insurance again on the truck and trailer… sigh.

Anyone have a good person or company that serves MO?

Must not have been much of a sportscar if you were only doing 122, LOL.

Let’s just say that was when I was slowing down lol. I really got lucky. Could’ve been much worse