I’ve been running a power washing and window cleaning business for about 5 years now, but our insurance rules from JD Walters changed. They say they won’t cover us for stepping on a roof. What insurance does everyone else use? My main thing is that I get on roofs all the time. I’ve never had a fall, I take good precautions and safety measures, but it’s difficult to find someone to give me insurance locally. The last thread about this was from almost 4 years ago. I live in Oregon, and any tips would help, thanks!

A lot of insurers don’t cover, or charge extra, for walking on roofs.

I use Erie insurance. In my state, and each state has it’s own rules and regulations, they will charge one price for PW and another for PW and walking on a roof. Don’t forget the other insurance yu need.

We went with Erie through a broker. All equipment, CCC, vehicles and roof cleaning is covered.

I’ve had to walk on roofs for like…25 years to get at a window. Haven’t done a roof wash yet though.

My local competition sent me a message saying he is sending me all the metal roofs he Gets this upcoming year.

…I think he’s trying to kill me ![]()

Haven’t there been at least 2 other insurance threads in the last month? lol

I’m sure they’ll be more.

So far in my research, no one covers me for falling off a roof. I’m a multi-member LLC, so I have to use my personal insurance for that. The Care Custody Control (CCC) topic is a huge one though, in that if I go to someone’s house and I drop a ladder on their car on accident, it’s not covered. I thought JD Walters used to cover things like that, but now that I have to search for a new insurance, I’m finding a lot of varying answers to this problem. I just want to go to a home, clean the windows, and if I break something anywhere, owned by anybody, I want to be covered. Any ideas for Oregon insurance? (Erie won’t work out here)

No one is going to cover everything you might break. I would think the ladder on the car example would be covered, but if you scratch up a window using the wrong tool, I doubt any would cover that.

I had an issue with a customers vanity - long story short, it was my fault so I was investigating insurance. My insurance company explained it like this. With GL, if a customer knocks over a bucket of paint, it’s covered. But if I knock it over, it’s not. To be covered for that, I needed to purchase professional liability in addition to GL (general liability) - this covers if I make a mistake while doing the job I was hired to do. (Not sure why my mind went to turbo nozzles there ![]() - dirtyboy and racer will remember that conversation)

- dirtyboy and racer will remember that conversation)

In any event - ask about professional liability coverage - mine wasn’t much more $. To talk to your first point - all of the insurance carriers I spoke with wouldn’t cover walking on roofs and when I asked about adding coverage for that it was in the thousands/year to get that coverage.

My insurance covers ladder use if it’s less than 15% of my time on a job site.

So if I’m there for 100 minutes, I can only be on a ladder for 15 of them.

I also can’t walk on a roof.

So this essentially limits me, especially gutter and window cleaning.

However, this is the only provider that protects me with overspray for plants/trees up to 15 feet from the house.

It’s super hard to get insurance for roof and ladder usage if under pressure washing category. If I do general construction, I’m not covered for damages caused by pressure washing, but I can use a ladder all day.

I’m also paying $2700 a year solo with 1 mil coverage.

The way insurance is going, not only for business but health and auto too, we are going to see some major price increases in our services to cover these costs or take on a lot more risk.

My lawyer recommended I keep 50% of my median annual business income in a savings account to cover uninsured expenses. A healthy business (financially) is seen better in the eyes of the law than one that has very little savings.

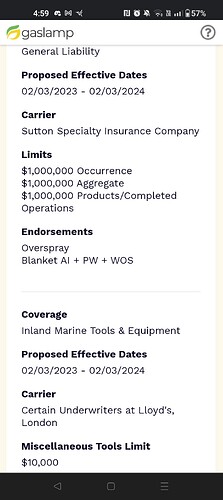

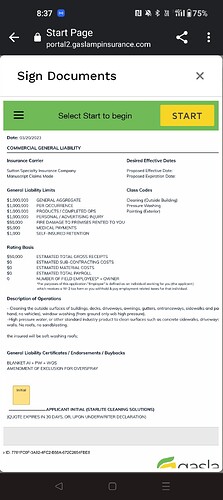

166 a month. They told me it covers roof walking and over spray. Seems a bit pricey as my insurance last year was 88 through someone else. Figured I’d share with you as I learn more with additional insurance as well.

“WOS”… walk on stuff? ![]()

Yeah I don’t know. I’m going to have to call them.

I kinda want general as well as personal liability and workers comp with the capability to walk on roofs but maybe I’m asking too much.

I just want a place where if if knock something over, or mess up their organic paint while doing a roof, I’m covered. I absolutely hate that companies love us paying monthly and on time but never intend to cover us when anything actually happens. I’m hoping to get a local quote back soon and have a few quotes to compare with them.

Being legit is annoying sometimes ![]()

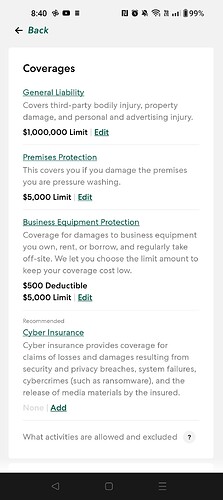

Through thimble it’s 95 a month and allows you to work on anything 3 stories or lower. I am unsure of the roof policy but assuming (which I shouldn’t be) that if they specifically mention 3 stories or less you’d be ok to…but that’s something you’d want to look into.

as an update, Thimble does NOT allow roof walking. Just got clarity on that one.

My deductible is $1,000 so even though I have insurance, it doesn’t do a whole lot of good other than providing proof of coverage. I’ve had three accidents in 10 years and all cost less than $1,000. I just paid the damage and never reported it to insurance. My most expensive was ruining a tile entrance. My employee ran it over full power with a surface cleaner. That evening it popped up like a tent. The tile guy said it was not laid properly and was just an accident waiting to happen. Tile was laid down and mortared, no underlying joint compound gluing it to the cement. Unfortunately, the house was owned by three lawyers and there was nothing I could do but pay for it.

When my GL insurance renewed last year, my agent also told me about the no roof rule. Work Comp also came down on me hard at renewal.

You have to wonder how a roofing company can insure 10+ guys using only a piece of foam but not us.

I’m so intrigued to see how much someone would get stuck with doing seasonal Xmas lights.

Just finally sorted out my insurance. It took a heck of a jump from last year though now looking back at it I might have been under insured and not known it.

This new one specifically covers soft washing roofs, over spray and plant damage. Could not find a company that would do all 3 except one and they want to charge 2300 for the year.

My local insurance company refused to insure me if I used SH as it’s considered caustic. Most others wouldn’t touch soft washing/washing roofs.

Feeling a little nauseous today as it’s 2300 for probably 6 months of coverage ![]()

I asked about this with my insurance and it was suggested I get Professional Liability insurance - this is in addition to general liability and in my case was only a few more dollars a year.

Same here with roofs - not covered for walking on a roof - thousands more annually to get that coverage here in Ga.