Hey everyone this is only going to be like my second post pretty new but have been reading a ton on this great forum. Okay so I live in Florida and am getting down to the wire of starting my new business getting some insurance quotes on general liability today. My wife talk to the first person locally that call her back and our question is this. General liability just covers the job etc. I will be pulling a trailer rig 5 x 10 with my truck. Do I need commercial insurance on my pickup truck? I know I need general liability. Do I also need to get a separate policy on theft for the trailer and its contents? That is my big question!

I have a commercial policy for my truck and trailer, inland marine policy for my contents…

Okay I definitely appreciate that I’ll check into those for sure if that’s available down here in Florida. My wife check today down here with some local commercial insurance place and they said something crazy like five grand

I think I recall @TexasPressureWashing mentioning someone in another thread too…

Expect to pay $850-1500 a year for $2 mil GL. Orlando Dorsey - Business Development at FrankCrum. 813-847-5895

I just went through the wringer on this.

GL for jobsite, contents of trailer need to be through that policy. Trailer itself and commercial auto is on a separate policy.

What is the standard Norm. Does everybody just have general liability? Do you have to have commercial insurance on truck and trailer? Do a lot of you guys not have theft on the contents?

Yes, you want a commercial auto policy for any vehicle or trailer used in the business.

They should be able to write you a “comprehensive” sort of policy that would cover theft or other damage to the equipment or vehicles. It might be called “inland marine” coverage, depending on the carrier you go with. But a good agent should be asking the right questions to make sure you get the right coverage.

I just switched agents and carriers for all of our business insurance. Now have all of it written through MMG (Maine Mutual Group, IIRC). Previously had separate carriers for auto and liability.

~$2100/year for:

- comprehensive commercial coverage on a 2019 Tacoma + ~$15k of permanently attached equipment

- water trailer with replacement value of $8k

- property coverage for a custom shed/shop with replacement value of $15k and a bunch more for materials and tools

- our general liability policy that covers us for up to 6 story lift work

A little over $100k/year in exposure

I think we got a really good deal

Okay thanks for the info! I want to have this all figured out by the beginning of next week. Waiting today on a cup of call backs from insurance companies to get some quotes.

I am just going to be a small one-man operation. Small trailer 5 by 10 soft wash system and 5 1/2 gal per minute machine, water tank, sh tank and soap tank.

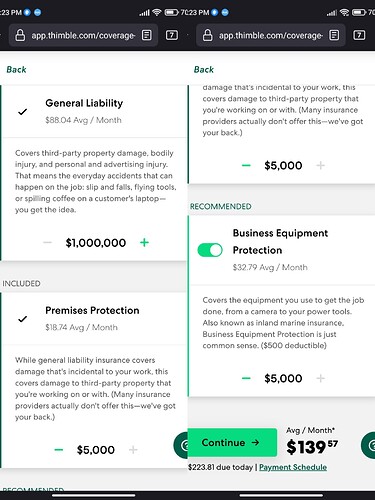

I’ve got commercial auto through Geico but it’s actually written by Berkshire Hathaway. One truck with full coverage and 100,000/300,000 limits. One trailer and equipment valued at 12,000 for 1400.00 per year. If you’re just starting out you can use Thimble Insurance. You can buy it in minutes on their website, or through their mobile app. They offer GL up to 2 million, CCC up to 5000, and inland marine up to 5000. I think inland marine only covers equipment on the job site or in storage, I don’t think it covers equipment if it’s stored or parked at your house. I could be wrong in that. You can cancel your insurance at anytime, and restart it whenever, which is great for seasonal businesses. You can also get short term policies by the hour or day if you’re only doing a very limited amount of work.

Went with a broker that deals with Erie, so far so good.

Thank you guys so much for the great info. This is starting to get real now trailer rig should be done within the next day or two. Now just have to lock in insurance, signs, extra parts, chemicals and whatever other two million things that I think I need LOL

Thimble specifically states they don’t cover things you damage while washing which effectively makes it useless insurance.

They changed it. Did you look at the pics I posted. They are from their website. You can add up to 5000 for property your working on. It may not be a lot, but it’s more than a lot of other companies offer. And it’s not useless, even if they didn’t offer it. There’s plenty of things that can happen on a jobsite besides damaging someone’s property that you’re specifically working on. In 33 years of contracting, I’ve never damaged anyone’s property to the extent of having to file a claim. If a ladder blows down and hits a customer or their car you’re covered. A customer trips over a hose and breaks a hip, you’re covered. It’s far from useless even if they didn’t offer CCC.

I guess 5k is better than nothing but I pay $1075 a year for far more coverage.

I can’t see a reason to choose them. Also if you need to file a claim you’ll likely need a lot more than 5k in coverage.

Really depends on someone’s location the insurance they have available to them. I’ve heard good things about Erie on here, but it’s not available in my state. I see several people on here use JW, and my quote from them a few years back was more than Thimble. Plus with Thimble, if he only has a 7 or 8 month season, he can pause it on demand until he returns to work. That would make it cheaper than that you’re paying.

139 x 7 is 973. So a little yes. I wish Erie was in more states as well.

I agree about not needing to file a claim as well. Mistakes do happen which is why we need insurance.

Yep, written plenty of checks for a variety of things. Wouldn’t even consider filing a claim that was under $5k personally…and haven’t filed one at all anyway.