How about a ‘single owner LLC’? My wife is trying to figure this out on the website.

It’s been stated that yes she would be eligible. I’d have to go find it though.

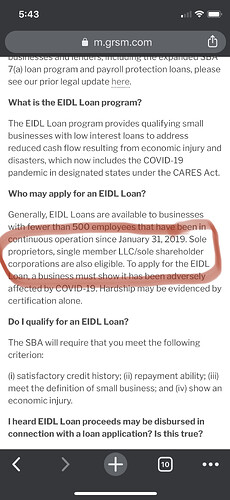

Yes she is. @seanktm you’re eligible to file. Don’t wait as it’s first come first serve. One of many sites breaking it down: Economic Injury Disaster Loans – Answers to Frequently Asked Questions

I would be if I had an employee or a contractor.

Business type is not issue for me. It’s the fact I had no one on my payroll. Different banks may do this differently as there’s a gray area such as this. I’m just letting you all know Chase handles it this way and if you’re a solo owner/operator, it may not work out at least through Chase, Again, another bank might be OK with it.

You’re eligible for both the PPP and the EIDL.

The PPP is more straight-forward and clear cut as to the strings attached regarding loan forgiveness.

I’ve read conflicting things on EIDL and loan forgiveness.

I applied for PPP on Saturday through my credit union. They called me yesterday and told me I was approved and they told me the amount.

If that’s the case, I’d find a different bank.

But I’m shocked Chase wouldn’t have their stuff together and know the particulars of the CARES Act.

Did you have any employees (besides yourself) or a contractor you paid last year?

No. Just me.

The form I filled out looked like a standard government form and had a box to mark for sole proprietor.

Same here, just myself…solo LLC. No employees.

Got it. Yes, perhaps I need to find a different bank. Banks don’t have a lot to gain with PPP but some to lose, so some banks will play it safe. It seems Chase might be playing it safe. I’ll look into other banks.

If you get the EIDL and the PPP, the EIDL will be rolled into the PPP loan. If you are following the rules the entire amount will be forgiven, if you are not, stand by because it will come back to bite you.

From SBA Email on the EIDL $10k loan.

To ensure that the greatest number of applicants can receive assistance during this challenging time, the amount of your Advance will be determined by the number of your pre-disaster (i.e., as of January 31, 2020) employees. The Advance will provide $1,000 per employee up to a maximum of $10,000.

So if your seasonal your out of luck. Unless the count 2019 employees. How far before Jan 31st 2020 can you go?

They basically said if the $10k EIDL Loan doesn’t work for you apply for the PPP Loan.

We got the approval letter from our bank yesterday for the PPP loan. A bit shy of $8k. They based it on average payroll for the 12 months prior to the disaster.

We paid ourselves very little for January and February, and our tax strategy has been to pay ourselves roughly 1/2 in salary and 1/2 in distributions. So this won’t really take us very far for this time of year when we are used to making more. We have cut all unnecessary spending and done some real belt tightening. It’s certainly better than nothing.

Still getting a decent amount of leads. I have a waiting list of people that want exterior services as soon as our state relaxes restrictions a tiny bit. Right now they don’t even want landscapers doing spring cleanups

I thought you were a sole proprietor with no employees.

S-corp with 2 employees (wife and I)

Well done

So did they just give you a % of payroll? How did they determine?