My bookkeeper informed me that filing is currently suspended. Here is to hoping it gets squashed.

Well hold on a sec now, the National Small Business Association filed a lawsuit and FINCEN suspended enforcement JUST on those 65,000 members, not EVERYONE.

Here’s a link to NC secretary of state. Those of us in NC may find some useful answers here. I’m always suspicious of "official looking’ emails I didn’t solicit, they even discuss some of those issues in this article.

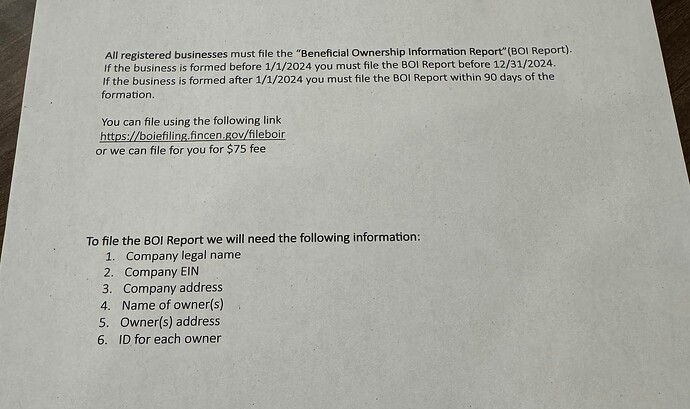

When I finished up my taxes with my accountant, he gave me this letter and told me to file the BOI report.

Quick search on google says “a person who willfully violates the BOI reporting requirements may be subject to a civil penalty of up to $591 for each day that the violation continues.” That person may also be subject to criminal penalties of up to two years imprisonment and a fine of up to $10,000."

They toss the word willyfully around a lot. I take it to mean intentionally. Whatever, I did it. Idk if I needed to or not but accountant told me to do it so I did. Took me about 10 minutes, just have an ID ready, I used my drivers license.

Edit: No cost to file.

Over the last week, I have been notified on separate accounts by my bookkeeper, bank, and a marketing email from Legal Zoom of the impending requirement to file before the end of the year… guess it’s not getting squashed and claiming ignorance isn’t allowed anymore as they seem to be getting the word out now.

Since the year is coming to an end, who has/hasn’t done this? Seems like it’s still going to move forward as of now.

I double checked with my CPA, he said it needs to be done. FYI was EZ

Have tried but their website has been down every time I’ve tried so today so… ![]()

Just did it, super easy and quick.

If you close your business after you have already filed with them do you have to let them know? Or just leave it alone ?Does anyone know ?

Thought I read somewhere there is no requirement to notify FINCEN of closure, assuming you went through the process of dissolving the business it should be on record. Thats just off the top of my head though.

@OhioFloMo I dissolved my former web/seo agency years ago, but the name is still registered as an entity in my state.

I asked my CPA, and he said as long as you have dissolution papers you do not need to file.

I’m in the process of starting a new agency, and waiting until January 1st to register it just to see what the guidelines for next year are.

Exactly, 10 minutes and a drivers license.

I don’t understand the point of all of it though. Its all information the Gov already has.