Not sure. I’m an LLC c Corp.

I will find that out when I return home.

Thanks for replying…

-PuJo

I think the filing fee varies by state.

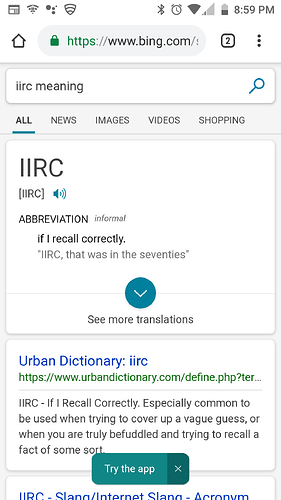

VT is $125, IIRC.

Had to look it up, lol. Here in VT, it’s $125 to file articles of incorporation (a one time fee when you first incorporate), and $45 for filing the annual report. For an LLC, the fees are even less.

At any rate, plan on most of your money going to the attorney and CPA.

Gotcha…

Thanks!

-PuJo

It’s usually the same every year. It’s set by the state that your business is registered in. For me it’s $195

A quick Google search and this is what came up.

Every year, you have to file a Louisiana LLC Annual Report to update the state on your LLC’s ownership and contact information. There’s no avoiding this $30 a year fee.

Don’t know if this will be my scenario but seems reasonable…

Louisiana is only $75 for articles and $30 for the annual report, according to google

Ha, you beat me to it

LOL

Seems like a lot of red tape just to go legit and pressure wash!

Well, you’re off to the right start. I didn’t incorporate until this year, and it’s my 13th year in business

Hopefully, once its all done and I start working, its easier to keep up with!

Cheers!

-PuJo

Did you actually incorporate or just become an LLC?

Don’t forget this little requirement:

"Louisiana requires LLCs to file an Annual Tax Statement, which is due on or before June 1. The fee for this report is $250."

My CPA is highly suggesting I become an LLC, even though it’s just me. Why would she do that if it won’t be effective?

There are numerous tax benefits depending on how you elected to be taxed. Either as a corporation or a single member LLC known as a “disregarded entity.” Most business owners that I talk to have no clue what the LLC is, what it does or difference between a corporation and a LLC for tax purposes or legal liability purposes.

Most LLCs won’t even provide liability protection in court because the owners didn’t put enough separation between them and the business entity.

Reasons you might want an LLC include: Limiting your personal liability for business debts. With an LLC , only the assets owned in the name of the LLC are subject to the claims of business creditors, including lawsuits against the business. … For most people, this is the most important reason to form an LLC .

I got this from Google. Plus she probably explained this to you or you should have asked.

That’s only if the business did the purchasing. For example you go down to Joe’s PW supply and fill out a credit app for an $8,000 hot water skid. Joe’s uses your SSN and personal credit report and fills out the contract with you as a personal guarantor and if you can’t pay, you are collected on personally and sued personally against your personal assets.

But, if Joe’s is willing to use the business tax ID number and pull your Dunn & Bradstreet report and write the contract to the business alone then you are correct.

I’ve run my IT business for 14 years as a Sole Proprietor. The big advantage is I can make both employee and employer contributions to a Solo IRA. I believe I can put a maximum of $52k away a year tax deferred.

Like I said, I quoted Google. Why is he asking us anyway? These are questions for his accountant.

Just like @squidskc quoted above (paraphrasing)…accountants are worth their weight in gold…

Only if you know what to ask them. And since there are two components to business structure (1) tax status and (2) legal liability, you also need a competent attorney.

My opinion is that a business owner needs at least a solid working knowledge of these matters. It’ not enough to just get a professional and depend solely on them to handle it.